Hey there! 👋 That fluttery feeling when retirement crosses your mind? Totally get it. Or maybe you’re just fantasizing about ditching traffic jams for sunrise coffees on the porch? Either way, you’re not flying solo! Navigating the “what comes after work” maze can feel like herding squirrels, especially with all the buzz about rising costs, rule changes, and the market’s wild rides. But here’s the straight goods: Getting your Canadian retirement savings strategies sorted for 2025+ is hands-down the kindest thing you can do for Future You. Picture way less nail-biting, way more freedom. Let’s walk through this together, step-by-step, no jargon allowed. Deal? Let’s roll!

🔔 Update Note for 2026/2027 Outlook: While we started this chat focusing on ’25, the financial landscape shifts fast. I’ve added specific updates below regarding the new CRA inflation adjustments and the CPP Enhancement Phase 2 that hits hard in 2025-2026. Keep reading to see how these rules change your math.

What’s Retirement Really Like in Canada Now?

Let’s paint the picture. Retirement today? Not your grandparents’ scene. We’re kicking around longer and healthier – wicked news! But… that means our nest eggs need to go the distance. Those retirement age trends Canada show the “work ’til 65 and hit the couch” script? Gathering dust. Lots of us are sliding into retirement sideways – maybe part-time gigs, launching passion projects in our silver years, or just downshifting gently. Oh, and let’s not kid ourselves – everything’s pricier now. That’s why crafting your own savvy Canadian retirement savings strategies for 2025 and beyond is non-negotiable. This isn’t just about clocking out; it’s about funding that fabulous life you’re dreaming of for potentially decades!

⚠️ The Hard Truth (Market Observation): Look, I talk to folks everyday who retired in 2022/2023, and the biggest regret I see isn’t “saving too little,” it’s underestimating longevity. If you retire at 60, you need to fund potentially 35 years of life. With Canadian inflation hovering unpredictably, your $500,000 portfolio might feel like $300,000 in purchasing power by 2035. We gotta plan for living too long, not just dying too soon.

Your Gov’t Safety Net: CPP and OAS Benefits in 2025

Think of CPP and OAS benefits as your financial sweatpants – comfy and reliable, but not runway material. They won’t fund champagne wishes, but they deliver steady cash – your foundation.

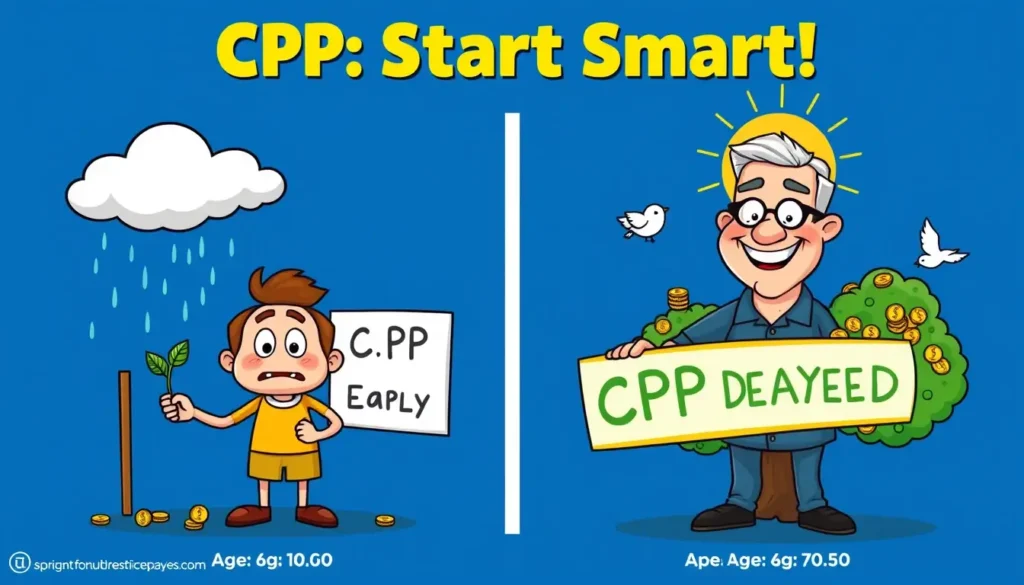

CPP: You’ve been feeding this with every paycheque. What you get back? Depends on what you put in and for how long. Hot 2025 Goss: The upgrades are fully baked! If you worked post-2019 (which you probably did!), you automatically paid extra, meaning fatter cheques later. The max monthly take in 2025 is beefier than before (sneak a peek at Service Canada for digits!). Your CPP retirement strategy matters: You can snag it as young as 60 (permanently trimmed amount) or hold out ’til 70 (for a permanently plumper payment). Deciding when to start? That’s your big play – chew on it!

📈 Technical Update (The CPP “Second Ceiling”): Pay attention here cause this is new. Starting around 2024/2025, the CRA introduced a second earnings ceiling (YMPE). Basically, if you earn more than the average (approx $68k+), you and your employer are now contributing slightly more on that extra income.

Why this matters for your 2026 plan: This isn’t just a tax grab; it’s a forced savings plan. These extra contributions mean the “Maximum CPP” payout is going to rise significantly for future retirees. If you are retiring in 2027 or later, your CPP slice will be larger than someone who retired in 2020. Factor this into your “Safety Net” calculations.

OAS: This one’s about your Canadian residency adult years (40 years = full amount). Kicks in at 65. Heads up: That income level where they start snipping back your OAS? It usually inches up yearly with inflation. Making serious dough later? This clawback bites – factor it in!

☕ Pro Tip From a Pal: Seriously, hop into your My Service Canada Account today. See your personal CPP and OAS benefits estimates. Best. Starting. Point. Ever. Know your base!

Your Money Muscle: RRSP Retirement Strategy & TFSA Retirement Planning

This is where you flex. Gov’t help is nice, but your own savings? That’s the engine revving your retirement dreams.

RRSP Retirement Strategy: The old faithful. Cash goes in pre-tax (cha-ching! tax refund now!), grows tax-sheltered, and you pay tax when withdrawing in retirement. Perfect if you’ll be in a lower tax bracket later. Room builds yearly (18% of last year’s earned income, up to a cap). Clever move? Max it during your big-earning years.

TFSA Retirement Planning: The Swiss Army knife of savings. Cash goes in after-tax (no instant refund), but then? Everything inside – interest, dividends, growth – is tax-free. Period. Withdraw anytime? Zero tax. Your room stacks up yearly after 18+ as a resident (check CRA MyAccount for your number!). TFSA’s retirement magic? Withdrawals don’t mess with gov’t benefits like OAS/GIS. Ultimate flexibility for any goal, especially retirement freedom.

The Golden Q: RRSP or TFSA for Retirement? (Spoiler: Probably Both!)

Honestly? They’re both rockstars. Think of them like kitchen gadgets:

- Grab the RRSP retirement strategy when: You’re in a high tax bracket now but expect lower later. Love that instant tax-return cash to reinvest? This is your jam.

- Reach for TFSA retirement planning when: Your income’s modest now, retirement tax might match or exceed today’s, you want tax-free cash that won’t nuke your benefits, or you like easy access to funds.

Stumped? Splitting your cash between both is almost always the brainiest, balanced Canadian retirement savings strategy. Cover your bases!

| Scenario | High Income Earner ($100k+) | Low Income / Student ($40k) |

|---|---|---|

| Best Tool | RRSP First | TFSA First |

| The “Why” (The Math) | You save approx 30-40% in taxes today on every dollar contributed. | Saving tax today doesn’t help much. You want tax-free withdrawals later. |

| The Trap | Withdrawing early destroys contribution room forever. | Over-contributing causes a 1% per month penalty (Ouch!). |

The Sneaky Thief: Impact of Inflation on Retirement

Remember when bread didn’t cost a small fortune? Yeah, inflation’s impact on retirement is that ninja slowly pickpocketing your buying power. Today’s loonie will barely buy a gumball 20 years into retirement. This inflation beast? Massive. Can’t sweep it under the rug.

Fight Back:

- Don’t Hoard Cash: Seriously. Park some money where it can outrun inflation long-term – think stocks or stock-heavy ETFs/funds. Yeah, they zigzag, but historically? They’re inflation’s kryptonite.

- Check Your Recipe: Stocks vs. bonds vs. cash? Give that mix a look-see now and then, especially nearing retirement. Maybe ease off the risk gas a smidge, but avoiding growth entirely? That’s like bringing a knife to an inflation gunfight long-term.

- Plan for Potholes: Bake some cushion into your retirement budget. Can you skip the fancy restaurant if avocado prices go bonkers?

🚨 Honest Warning (The Fee Trap): Speaking of fighting inflation, watch out for “MERs” (Management Expense Ratios). Many big Canadian banks sell mutual funds with fees of 2% to 2.5%.

Why is this bad? If the market returns 6% and inflation eats 3%, and your bank takes 2.5%… you are left with 0.5% real return. That’s not growing; that’s stagnating. Look for low-cost ETFs or “Robo-advisors” where fees are closer to 0.5% or less. This small switch can save you $100,000+ over 20 years. I’ve seen it happen.

Your Magic Number (“Seriously, How Much?!”)

The million-dollar question! (Sometimes literally!). Truth bomb: There’s no magic number for Canada retirement planning 2025. It’s all about you:

- Dream retirement vibe? (Beach bum? Urban explorer? Grandkid spoiler?)

- Future zip code? (Downtown condo = Downtown dollars).

- Health forecast? (Gotta consider potential care costs).

- Other income? (CPP and OAS benefits, company pension, side hustle?).

- Debt-free goal? (Aim to kiss that mortgage goodbye before retirement!).

A rough ballpark? Many aim for 70-80% of their pre-retirement yearly income. But honestly? Your best move is tracking current spending. See where your cash actually flows. Then imagine retirement: Less on dry-cleaning? More on golf memberships? Online calculators (gov’t/banks) are handy starting points, but your real life is the ultimate blueprint.

When’s the Right Time to Bail?

Those retirement age trends Canada prove the “65” finish line? More of a suggestion now. Folks are rewriting the rules:

- Early Exit (Pre-65): Super tempting! But… your savings marathon gets longer, CPP shrinks if taken early, and OAS isn’t ready. Needs a bulletproof Canada retirement planning 2025 strategy.

- “Classic” (Around 65): OAS kicks in fully. CPP at standard rate. Still needs serious savings muscle.

- Later Liftoff (Post-65): This can be a game-changer for your CPP retirement strategy (hello, bigger cheques!) and lets your savings simmer longer. Plus, maybe you dig the social buzz or extra cash from part-time work.

The right time is yours alone. It’s less about the calendar, more about your wallet and your gut saying “Go!”.

🧮 The Math of Waiting (Expert Insight): Just to clear up a common confusion I see: For every month you take CPP before age 65, you lose 0.6%. That doesn’t sound like much, but it’s 7.2% per year.

If you take it at 60, you are permanently losing 36% of your paycheque. Unless you have health issues or urgent debt, waiting until 65 (or even 70 for the 42% bonus) is the best “guaranteed return” you can find in Canada right now. It’s strictly math.

Don’t Blow It on Healthcare! (The Budget Bombshell)

Okay, Canadian healthcare rocks, but it doesn’t cover the full retirement menu – a hidden impact of inflation on retirement you can’t ignore:

- Medications: Provincial plans vary wildly, and workplace benefits often vanish at retirement. Budget for pharmacy bills or private insurance premiums.

- Chompers: Cleanings, fillings, crowns? Ka-ching! The new Canadian Dental Care Plan helps some seniors, but check the fine print – it’s not a free ride.

- Eyes: Glasses, contacts, exams add up.

- Ears: Hearing aids? Brace yourself – they’re shockingly spendy.

- Future Care Needs: Heavily subsidized, sure, but depending on needs and location? Costs can skyrocket fast.

Bake these into your budget. Seriously. They’ll torpedo your Canada retirement planning 2025 faster than you can say “unexpected expense”.

Build Your Plan (Minimal Panic Required!)

Feeling overwhelmed? Join the club! Here’s how to tackle your Canadian retirement savings strategies:

- Round Up Your Numbers: Dig up CPP and OAS benefits estimates, list all savings pots (RRSPs, TFSAs, pensions), face your debts.

- Follow Your Money: Track current spending – it’s retirement’s crystal ball.

- Vision Board It: What does dream retirement really look like? Get nitty-gritty!

- Math Time: Use calculators, scribble on a napkin, whatever works. Be brutally honest about returns (don’t daydream!) and inflation’s impact on retirement (don’t ignore the elephant!).

- Savings Sprint Plan: How much extra needs to go in monthly/yearly to hit your target?

- Investment Health Check: Does your portfolio still match your comfort zone and timeline? Tweak needed?

- Call in the Calvary?: A fee-only certified financial planner (CFP)? Can be worth every dime. They give unbiased advice crafted just for you, especially for tax tangles or complex Canadian retirement savings strategies. Genius move.

☕ Quick Reality Check: Stick a yearly “Canada Retirement Planning 2025 Tune-Up” in your calendar. Life throws curveballs, rules shift, markets dance. Your plan needs to boogie too!

Bottom Line: Your Tiny Next Moves

Phew! We covered real ground, right? The takeaway? Nailing your Canada retirement planning 2025 isn’t rocket science. It’s about knowing the players (gov’t basics, your savings mojo, inflation’s impact on retirement, your dreams) and building a plan that fits your story. Start right where you stand. Use the tools (Service Canada, CRA logins!). Get savvy. Make saving as routine as your morning brew.

Don’t try to eat the whole elephant today. Just take one bite:

- Today: Jump into My Service Canada. Write down your CPP estimate. Boom!

- This Week: Peek at CRA MyAccount. What’s your TFSA/RRSP retirement room look like?

- This Month: Jot your top 3 retirement dreams & one micro-step toward just one.

Found this helpful? Toss it to a friend who’s also dreaming of easy street! Sharing is caring. 😊 You’ve totally got this!

FAQs: Real Talk Retirement Qs

Q: TFSA vs RRSP? My head’s spinning!

A: It is confusing! Cliff Notes:

- RRSP retirement strategy wins when: High tax bracket now, expecting lower later. That sweet tax refund now gets you jazzed.

- TFSA retirement planning wins when: Income’s lower/moderate now, retirement tax might match/higher? Want tax-free cash that leaves OAS/GIS untouched? Need to grab cash without penalties?

Can’t decide? Splitting your dough is usually the smart money move. Don’t paralyze yourself!

Q: What’s CPP & OAS actually paying in 2025?

A: Exact CPP and OAS benefits creep up with inflation yearly. For 2025, eyeball Service Canada’s site later (or check 2024 numbers now for a decent guess). Rough 2024 maxes:

- CPP @ 65: ~$1,364/month

- OAS @ 65: ~$713/month

(Most get less than max CPP). Your My Service Canada Account has your magic number!

Q: Seriously, should I delay CPP past 65?

A: It can be a masterstroke for your CPP retirement strategy! Each month you delay past 65 (max age 70), your payment jumps 0.7% (that’s a fat 8.4% yearly!). If longevity runs in your family and you don’t need the cash ASAP, delaying supercharges your lifetime income – especially if you’ve got other savings (TFSAs!) to bridge the gap. Worth pondering.

Q: How do I actually invest my RRSP/TFSA? I’m clueless!

A: You’re not alone!

- Gut Check: How much market rollercoaster can you stomach before losing sleep? Be real.

- Spread the Love: Don’t bet it all on one horse! Low-cost ETFs or mutual funds holding zillions of stocks/bonds are your BFFs.

- Fees are Silent Killers: High fees gnaw your returns over decades. Hunt for low MER options.

- Robo-Advisor Route? These auto-pilot services build/manage a diverse mix for you based on your risk vibe, usually cheaper than a human advisor. Perfect starter kit!

- Phone a Friend (Pro): Still queasy? A fee-only financial planner crafts a plan that fits you and lets you sleep soundly. Worth it for peace of mind!