Hi friends! That moment of dread is becoming a yearly ritual, isn’t it? You open your health plan renewal notice for 2026, and there it is—another significant jump in your premium. You know what? You’re not imagining it. While healthcare inflation is a constant background hum, 2026 is facing an acute, two-pronged squeeze that’s pushing costs into new territory. This guide will dissect the two main culprits—soaring cancer treatment bills and the mainstreaming of fertility coverage—giving you concrete data and, more importantly, real strategies to navigate these choppy financial waters.

A recent analysis by WTW indicates that while healthcare cost increases in 2026 may be slightly lower than those in 2025, the overall hikes remain significant. This sets the stage for our deep dive into the specific forces shaping your 2026 medical costs and medical insurance premiums.

The Unavoidable Math: Understanding the 2026 Medical Cost Trajectory

First, let’s get our heads around “medical trend.” Think of it as the projected speedometer for the cost of medical services—how much faster healthcare prices are growing compared to everything else. For 2026, this trend is still running hot. Insurers and employers are looking at persistent high single-digit increases globally.

But here’s the kicker: this isn’t uniform. In some markets, the rise is even sharper. For instance, Hong Kong health insurance costs are projected to rise by 9.9% in 2026, as warned by WTW. This stark example shows how local factors can supercharge the global trend. The usual suspects—our aging populations, the rise of chronic diseases, and expensive new medical tech—are all still in the picture, steadily pushing the baseline cost up.

While these factors provide the baseline, two emerging forces are applying unprecedented pressure on claims portfolios for 2026 and beyond. Understanding these is key to decoding your premium notice.

Driver 1: The Soaring Cost and Frequency of Cancer Claims

Here’s a hard truth: cancer is becoming more common, and treating it is becoming astronomically more expensive. We’re not just talking about a slight uptick. The financial impact of rising cancer claims is now one of the most significant factors in health insurance pricing.

The story isn’t just about expensive chemotherapy drugs anymore. A modern cancer journey involves a cascade of high-tech costs: advanced genomic testing to personalize treatment, cutting-edge immunotherapy courses that can run into hundreds of thousands of dollars, highly targeted proton therapy, and then long-term survivorship care. The average cost per cancer claim is skyrocketing due to these new therapies.

For employers, especially small and medium-sized businesses, this “claims severity” is a nightmare. A single employee’s advanced cancer diagnosis can be a catastrophic event for the company’s health plan budget, leading to a double-digit premium shock at renewal. Insurers, seeing this trend across their entire book of business, have no choice but to price this severe risk into everyone’s premiums.

Driver 2: Fertility & Family-Building Coverage Enters the Mainstream

Now, let’s talk about a seismic shift in benefit expectations. Procedures like In Vitro Fertilization (IVF), egg freezing, and intrauterine insemination (IUI) have rapidly moved from rare, executive-level perks to expected components of a competitive benefits package. Companies are adding these to attract and retain talent, particularly younger demographics.

Honestly, the unit cost is staggering. A single IVF cycle can easily cost between $15,000 and $30,000, and success often requires multiple attempts. This expansion aligns with broader policy discussions, as highlighted in analyses of ‘issues affecting women’s care and access,’ which increasingly frame fertility treatment as a core component of healthcare equity.

From an insurer’s perspective, adding fertility coverage is like introducing a predictable, high-utilization cost line into the plan. Actuaries know that if they offer it, a certain percentage of the insured population will use it, and they price that risk directly into the premium. The contrast with cancer is key: fertility claims are often high-frequency and high-cost per event, while cancer is lower-frequency but with catastrophic cost per event. Both strain the system, but in different, compounding ways.

The Premium Impact: What Employers and Individuals Can Expect in 2026

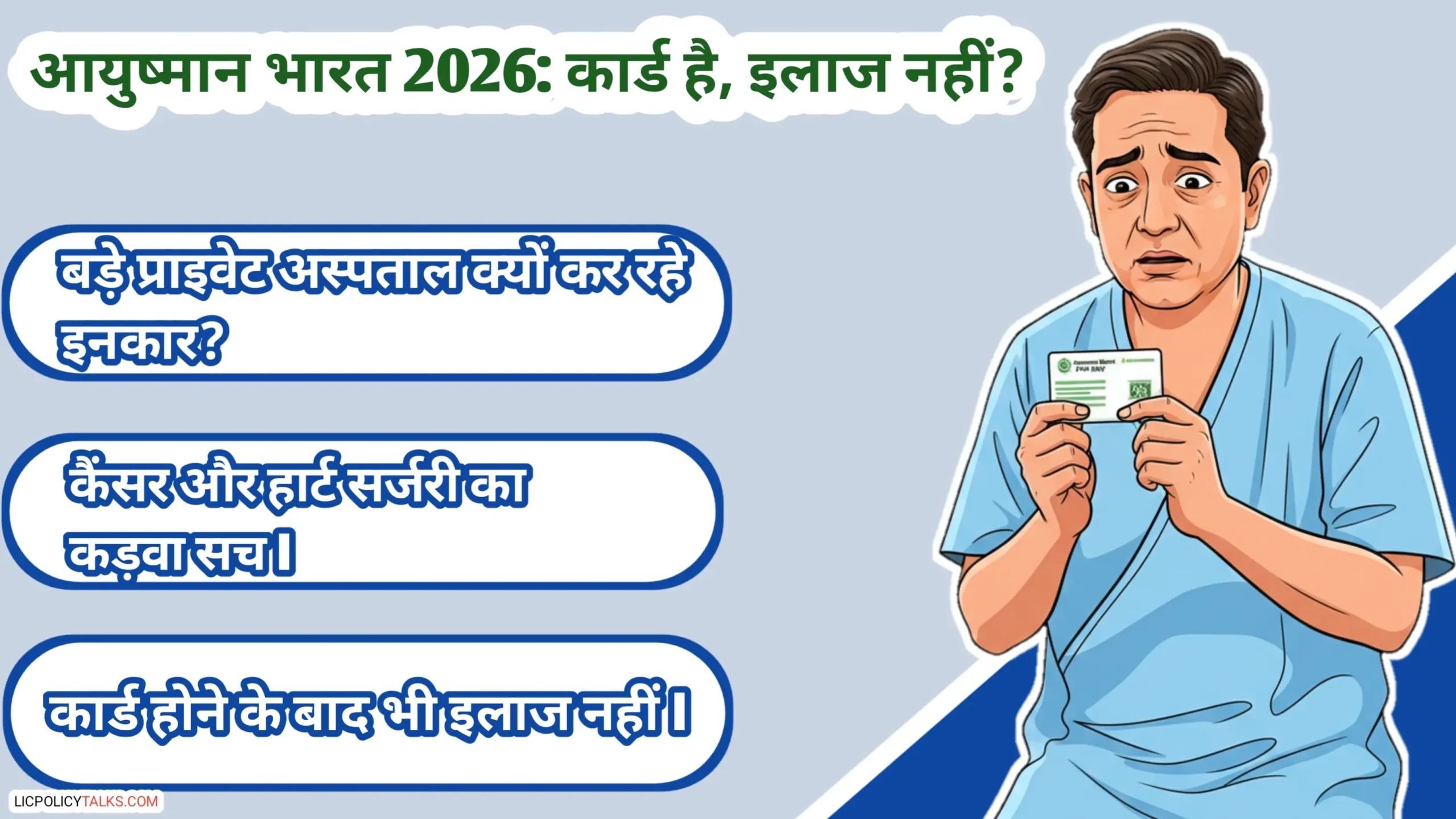

So, how do these two drivers translate to your bottom line? Insurers basically act like mathematicians of risk. They aggregate all the projected claims—from the soaring cancer treatment costs to the new wave of fertility treatment insurance claims—add their administrative costs and a profit margin, and voilà, you have your premium. Plans that offer comprehensive coverage in both these areas will see the highest baseline renewals.

When that renewal quote lands, don’t just look at the final number. Scour the accompanying documents for phrases like “catastrophic claims experience” or “benefit expansion impact.” These are often code for the cancer and fertility pressures we’ve discussed. This makes the annual open enrollment window a critical time to assess coverage. Experts advise comparing plan networks and understanding out-of-pocket costs against anticipated needs during this period.

For individuals not covered through an employer health plan, state-based exchanges like Covered California provide platforms to shop for 2026 plans. The key is to enter this shopping phase with your eyes wide open to these underlying cost drivers.

| Factor | Estimated Impact on Premium | Notes |

|---|---|---|

| General Medical Inflation (Services, Drugs) | +3.5% to +4.5% | Baseline trend |

| Rising Severity of Cancer Claims | +1.5% to +2.5% | Driven by advanced therapies |

| Addition of Fertility Treatment Coverage | +0.5% to +1.5% | Depends on benefit generosity |

| Administrative Costs & Profit Margin | +0.8% to +1.2% | Relatively stable |

Strategic Responses: Mitigating Costs Without Cutting Care

Feeling overwhelmed? Don’t be. You have more power than you think. Here’s how different groups can fight back against these healthcare cost drivers.

For Employers & HR Professionals:

1. Advanced Analytics: Dive into your own claims data. Is your workforce showing specific risk patterns? This intel is gold for negotiating.

2. Benefit Design Nuance: With fertility, consider smart caps, bundled pricing with specific clinic networks, or a defined contribution approach (e.g., a $20,000 lifetime benefit).

3. Cancer Support Networks: Partner with insurers that offer top-tier oncology case management. Second opinion services can ensure care is appropriate and cost-effective from the start.

4. Employee Education: Double down on promoting preventive care and early screening. A detected early-stage cancer is far less costly to treat than a late-stage one.

For Individuals and Families:

1. Scrutinize During Open Enrollment: Model scenarios. If you’re planning a family, estimate the out-of-pocket for an IVF cycle. Understand your total risk.

2. Understand Networks: Before enrolling, verify that your preferred cancer center or fertility clinic is in-network. Out-of-network care is a budget killer.

3. Consider Supplemental Insurance: A critical illness plan that pays a lump sum upon a cancer diagnosis can be a financial lifesaver, offsetting deductibles and other expenses.

The Road Beyond 2026: Long-Term Trends to Watch

Looking past 2026, the medical trend forecasting exercise gets even more interesting. Keep an eye on GLP-1 drugs (like those for obesity and diabetes). If coverage for these high-demand, chronic-use medications becomes standard, they could be the next major cost driver. The impact of AI and precision medicine is a double-edged sword—it might raise short-term costs due to new technology but could lower long-term expenses by enabling better, faster outcomes.

The policy landscape around reproductive health will continue to evolve, directly affecting benefit design. The bottom line? Managing healthcare cost drivers is no longer a once-a-year renewal surprise. It’s a continuous strategic exercise. Being informed about these forces is your first and most powerful line of defense.